Leadership Snapshot

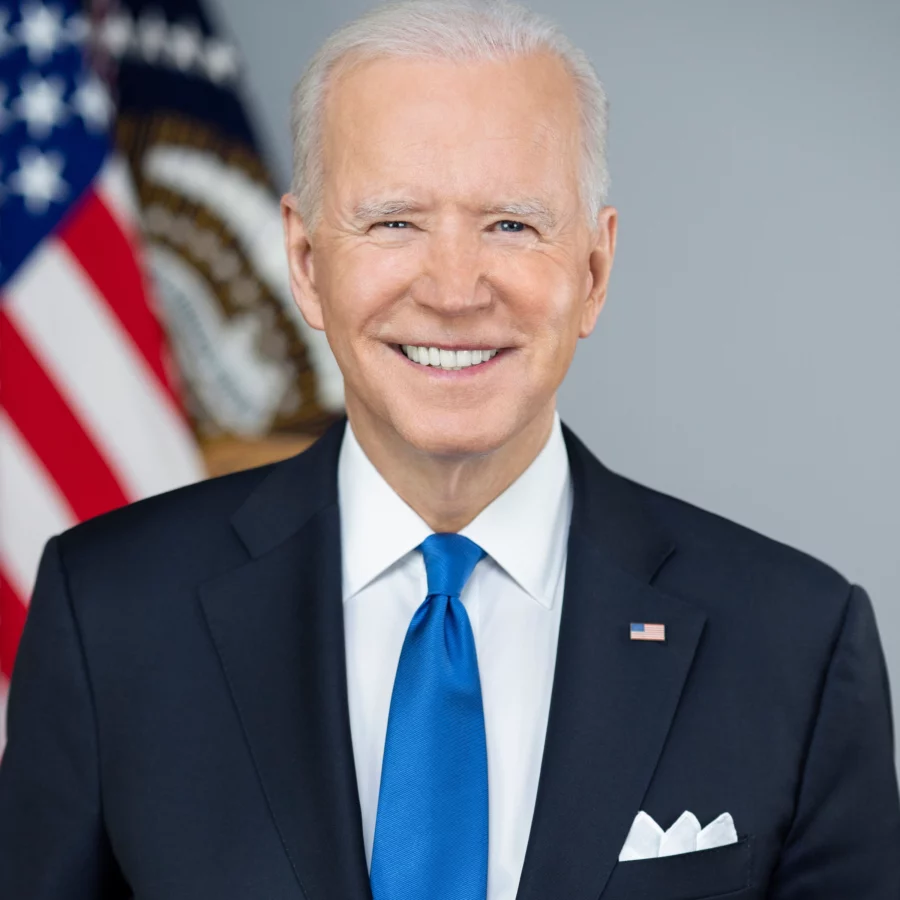

Joe Biden

Compare Legislators

See How Legislators Voted on These Issues

- Lifetime Score

- Session Score

Voted Against Freedom

News Stories You Can Use

The 2-Year Treasury Yield Is Scary. How It Weighs on Stocks.

Higher Interest Rates Means More Spending

Barron's

FCC move to restore net neutrality sets stage for familiar fight

FCC Is Going Far Beyond Its Authority

Roll Call

Congress Could Overturn a New Rule Limiting Credit Card Late Fees. Good.

Card Holders May See Higher Interest Rates If the Rule Stands

Reason

House Republicans confront fight over FISA reauthorization

Johnson Sold Out Americans' Fourth Amendment Rights

CNN